U.S. Consortium Acquires Chinese Port Holdings in Panama Amid Geopolitical Tensions

In a significant shift in global maritime infrastructure ownership, a U.S.-led consortium comprising BlackRock’s Global Infrastructure Partners and Terminal Investment Limited (TiL) has acquired the majority of Hong Kong-based Hutchison Port Holdings’ non-Chinese assets, including strategic terminals at Panama’s Balboa and Cristobal ports.

Strategic Acquisition Reshapes Global Port Operations

The $22.8 billion deal gives the BlackRock-TiL consortium control of 90% of Hutchison’s Panama operations and an 80% stake in 199 berths across 43 ports in 23 countries. This transaction excludes Hutchison’s properties in mainland China and Hong Kong.

This acquisition follows recent assertions by President Donald Trump regarding Chinese influence over the Panama Canal—a vital maritime passage connecting the Atlantic and Pacific Oceans that was transferred to Panamanian control in 1999. Trump had claimed Chinese military control over the waterway and alleged discriminatory practices against American vessels.

While Hutchison (0001.HK) has officially denied that the sale resulted from political pressure, the timing coincides with the U.S. government’s decision to double tariffs on Chinese imports to 20%, a measure aimed at addressing concerns over fentanyl trafficking.

Implications for Global Shipping Networks

The transaction represents a significant realignment in the global port operations hierarchy. Prior to the sale, Hutchison ranked as the world’s sixth-largest terminal operator, handling 43 million TEUs (twenty-foot equivalent units) in 2023—approximately 5% of global volume, according to shipping analyst Drewry.

MSC, which backs TiL, previously held the seventh position with 42.3 million TEUs (4.9% market share). This acquisition potentially consolidates their position closer to industry leader PSA International of Singapore, which handles 62.6 million TEUs (7.2% market share).

The deal awaits approval from the Panamanian government, and questions remain about how operations for competing shipping lines at former Hutchison ports will be affected.

How FPSAU Supports Clients Through Maritime Transitions

As these significant ownership changes unfold in global port infrastructure, we stands ready to help clients navigate potential disruptions and capitalise on emerging opportunities:

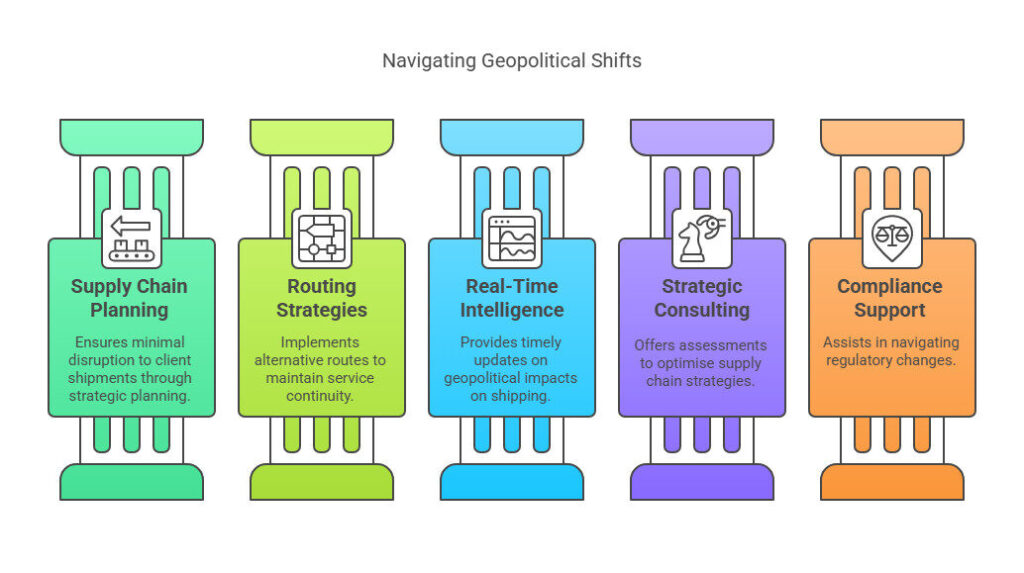

Supply Chain Continuity Planning: Our logistics experts are monitoring this transition closely to anticipate any operational changes at affected ports, ensuring minimal disruption to client shipments through these critical gateways.

Alternative Routing Strategies: With our extensive network across the Asia-Pacific region, we can quickly implement alternative routing options should any service disruptions occur at the Panama facilities during this ownership transition.

Real-Time Intelligence: Our dedicated market analysis team provides clients with timely updates on how these geopolitical shifts may impact shipping schedules, port congestion, and transit times.

Strategic Consulting: For businesses concerned about how these changes might affect their long-term supply chain strategy, our 4PL consulting services offer comprehensive assessments and recommendations to optimise routing and minimise risk.

Customs and Compliance Support: Our specialists can help navigate any regulatory changes that may emerge from this shifting geopolitical landscape, particularly for goods moving through newly acquired terminals.

We remain committed to providing stability and continuity for our clients during this period of significant change in global maritime infrastructure. Our established relationships with major carriers and terminal operators worldwide position us uniquely to mitigate potential disruptions while identifying opportunities created by these industry shifts.

For businesses seeking guidance on how these developments might impact their specific shipping requirements, our team of logistics professionals is available for personalised consultations. Visit Famous Pacific Shipping Australia or call 1300 377 007 today.